The CSA conducts investor research studies to better understand the relationships Canadians have with investments, and their views on fraud and regulators. This research also helps us develop new programs and enhance existing ones based on the needs of Canadian investors.

2024 CSA Investor Index

The 2024 CSA Investor Index provides valuable insight into Canadian investing trends and fraud in an ever-evolving financial landscape. The long-running survey, first published in 2006, tracks key measurements, including investor behaviour, knowledge, confidence, attitudes towards risk, and incidences of investment fraud. This year, the questions were around the shifting investment landscape such as Do-It-Yourself investing, sources of information, optimism in the Economy, and many more. The full Index is available here.

The 2024 CSA Investor Index survey was conducted in March 2024. It consisted of a representative sample of 7,215 Canadian adults, weighted by age, gender, province, and education using 2021 Statistics Canada census data to reflect the actual demographic composition of the population.

Key findings

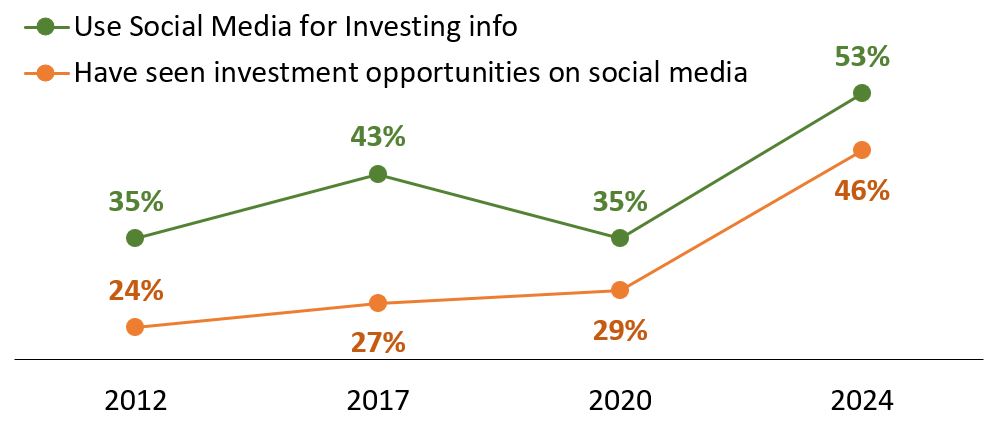

More Canadians are using social media for investment information: Investors who use social media for investment information increased 18 per cent since 2020 to 53 per cent. Notably, 82 per cent of 18- to 24-year-old investors use social media, with YouTube, Instagram and TikTok being the most popular choices in this age group. Moreover, 46 per cent of Canadians report encountering investment opportunities on social media, which is a 17 per cent increase from 2020, and is also especially common among younger age groups.

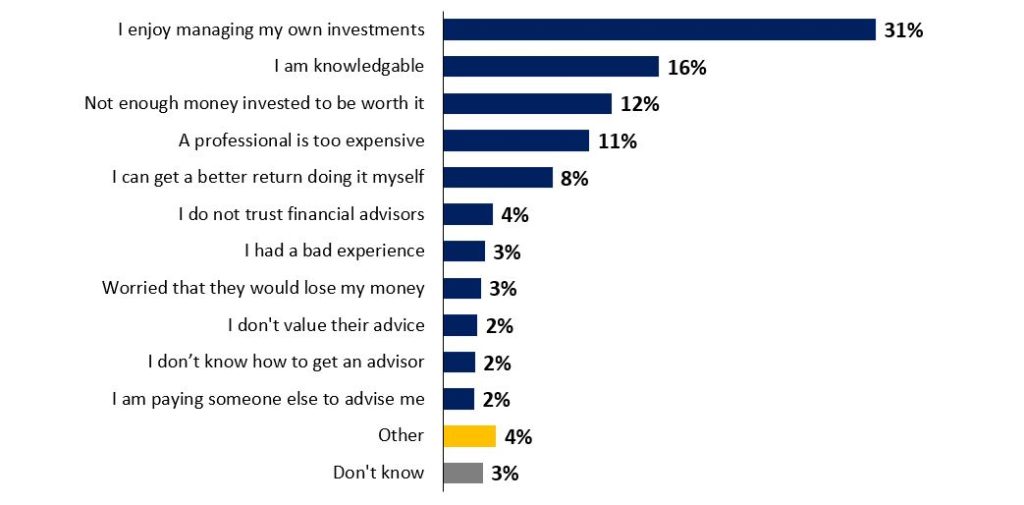

Nearly half of investors say they DIY invest: Forty-five per cent of investors say they have a self-directed account, and 30 per cent of these DIY investors first opened that account within the last two years.

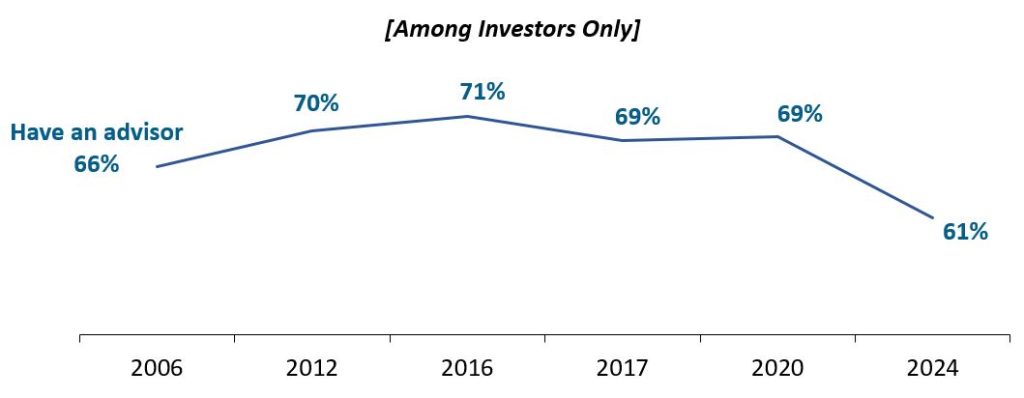

Fewer investors report having a financial advisor in 2024: Sixty-one per cent of investors said they currently work with a financial advisor, down eight per cent from 2020. The largest drop was for investors under the age of 45 and those with portfolios less than $100,000.

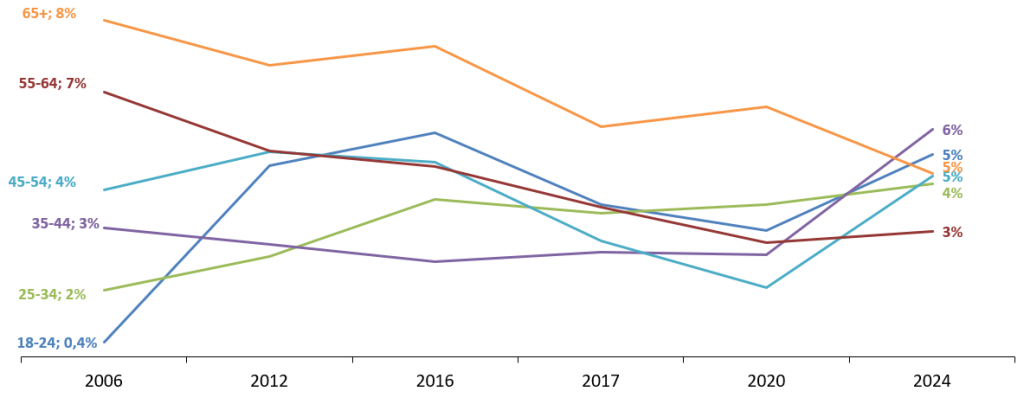

Investment fraud trends upward for younger investors: While investment fraud has decreased in older demographics since 2006, reported fraud doubled with almost all other age groups. Younger investors 18-24 years old saw the highest reported increase from 0.4% to 5%.

- View the 2024 CSA Investor Index Executive Summary

- View the 2024 CSA Investor Index

- View the 2024 Press Release

CSA Investor Research Study on the Impact of CRM2 and POS, 2016-2019

The CSA conducted investor research to measure the impacts of requirements introduced by Phase 2 of the Client Relationship Model (CRM2) and the Point of Sale (POS) amendments on investors. The CSA conducted this study through a series of surveys of Canadian investors.

The research included one baseline survey by Ipsos Public Affairs in 2016 of about 3,500 Canadian investors, followed by six successive waves of semi-annual surveys, each with about 2,000 respondents, conducted by Innovative Research Group. Each survey included 50 questions that collected information on over 150 measurable items.

The research package comes in two parts:

- CSA Summary Report: Reports on trends found in the survey results over the four years of the study. An appendix in this report also contains the text of the survey.

- 2019 Annual Report: Reports on results of each question in the study for all four years (2016 to 2019). Contains sections for results nationally, by province, and by advisor relationship segment

Previous investor research studies

2020 CSA Investor Index Study

- View the 2020 CSA Investor Index Executive Summary

- View the 2020 CSA Investor Index

- View the 2020 Press Release

CSA Investor Education Study 2017

- View the 2017 CSA Investor Index Executive Summary

- View the 2017 CSA Investor Index

- View the 2017 Press Release

CSA Investor Education Study 2016

2012 CSA Investor Index

- View the 2012 News Release

- View the CSA 2012 Investor Index Executive Summary (PDF)

- View the CSA 2012 Investor Index (PDF)

2010 CSA Survey on Retirement and Investing

- View the 2010 News Release

- View the 2010 Executive Summary (PDF)

- View the 2010 CSA Survey on Retirement and Investing (PDF)

2009 CSA Investor Index

- View the 2009 News Release

- View the CSA 2009 Investor Index Executive Summary (PDF)

- View the CSA 2009 Investor Index (PDF)

2007 CSA Investor Study: Understanding the Social Impacts of Investment Fraud

2006 CSA Investor Index

Please note:

Links to and use of our materials by third parties do not constitute endorsement by the CSA or by provincial or territorial regulators. Please see the important note on our Legal page.For more information, or if you would like to use any of the CSA content or materials, please read our guidelines for acceptable use.